Pan Card Aadhar Card Link 2023 – Linking your PAN card and Aadhaar card is an important process in India to establish a connection between these two essential identification documents. The Government of India has made it mandatory for individuals to link their PAN (Permanent Account Number) and Aadhaar cards to eliminate duplicate or fraudulent PAN cards and to promote transparency in financial transactions. This process helps in verifying the identity and reducing tax evasion.

The PAN card is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India, while the Aadhaar card is a twelve-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). Linking these two documents ensures seamless integration of personal information and facilitates various financial and government-related services.

The linking process involves providing certain details from both the PAN card and Aadhaar card, and the information is cross-verified to establish a connection between the two. This helps in ensuring accurate and updated information across different platforms and services.

Linking your PAN card and Aadhaar card can be done through various methods provided by the Income Tax Department, including online and offline methods. The online method typically involves visiting the Income Tax Department’s official website or through the UIDAI portal. Offline methods may include visiting designated PAN service centers or authorized intermediaries.

It is important to note that the deadline for linking PAN and Aadhaar has been extended multiple times by the government to ensure wider compliance. However, it is advisable to complete the linking process as soon as possible to avoid any inconvenience and to stay compliant with the regulations set by the authorities.

Through this article, I will tell you in detail about PAN Card Ko Aadhar Card Se Kaise Link Karen, how you can do PAN Aadhaar Link Online in easy ways. So that you do not have to face any kind of inconvenience and you can do it from Aadhar Card Se PAN Card Link sitting at home.

Pan Card Aadhar Card Link – Overview

| Department Name | Income Tax Department Government of India |

|---|---|

| Category | government scheme |

| Article Name | Pan Card Aadhar Card Link |

| Objective | Help in the financial department, filing taxes, as an identity card |

| Link Mode | Online/Ofline |

| Official Website | https://www.incometax.gov.in/iec/foportal/ |

Disadvantages due to not linking PAN Aadhaar

If you have not linked your PAN card with Aadhaar card before the deadline set by the government, then you may have to bear the following losses-

- Will not be able to file income tax return

- PAN may be invalid

- Will not be able to do financial transactions of high value

- There may be delay in the process of tax refund

What are the benefits of Aadhaar Se PAN Link?

Following are the benefits of linking Aadhaar to PAN –

- To avoid fraud, it has been made mandatory by the government to link PAN card with Aadhaar.

- If more people pay tax, then the government will save more money, so that the government will be able to run more schemes for the benefit of the common man.

- There are many people who hide their income by making more than one PAN card and now with the link they will not be able to hide their income and pay taxes.

- With Link Aadhaar To PAN, the government will have information about everyone’s accounts, which will help in preventing tax evasion.

Pan Card Aadhar Card Link 2023

If you are also sitting at home, you can follow the following steps for Aadhar Card Ko PAN Card Se Kaise Link Karen –

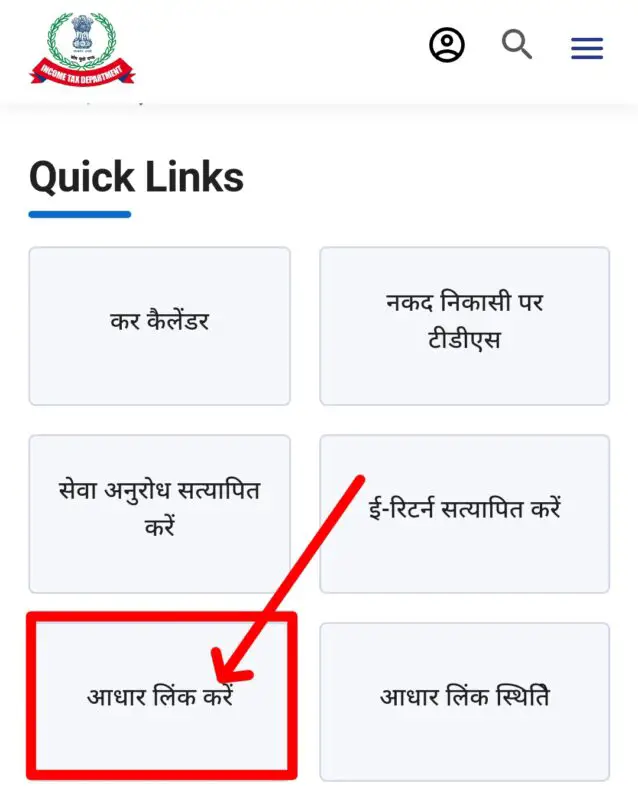

- First of all visit the official website of Income Tax.

- After that go to the “Quick Links” section and click on the “Link Aadhaar” button at the bottom.

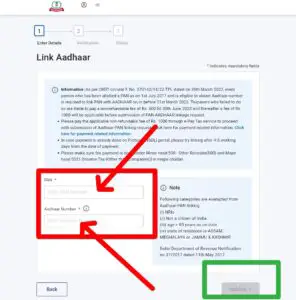

- As soon as you click, a page will open in front of you, scroll down and enter the PAN number and Aadhaar number, click on “Validate”.

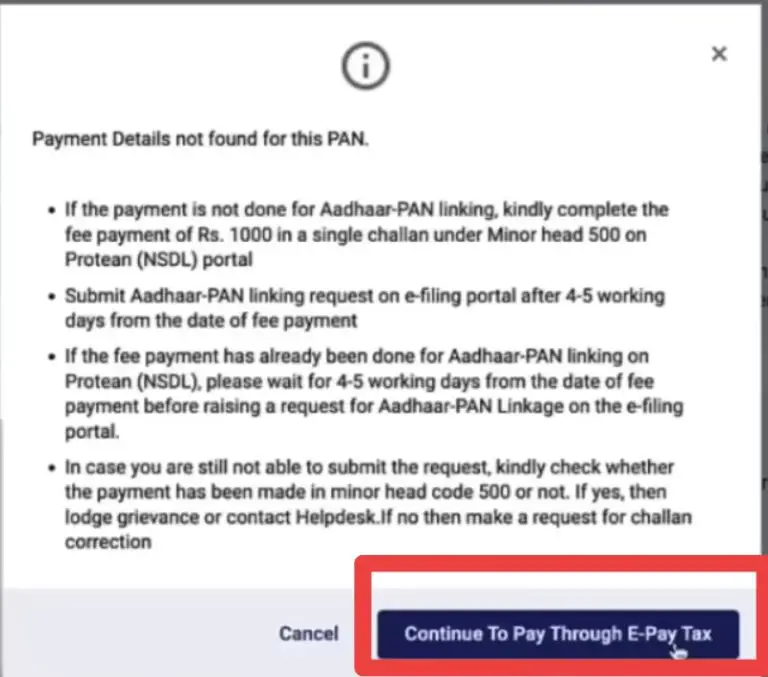

- After this you will be asked for payment, then you will see the following option, in that you will see “Continue to Pay E-Pay Tax” below, click on it.

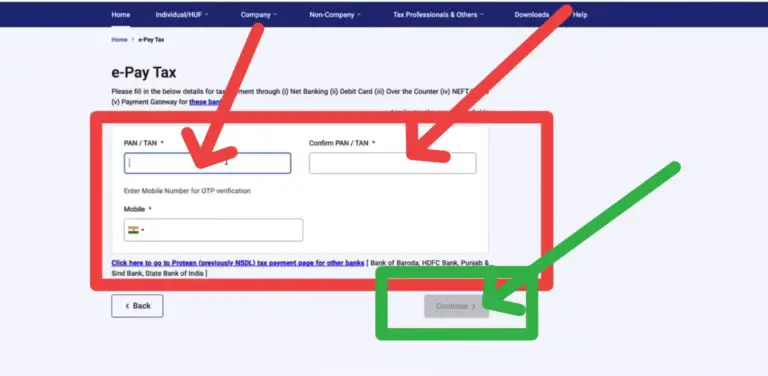

- After clicking, a page named E-Pay Tax will open in front of you.

- After entering the PAN/Tan and Confirm PAN/Tan number, after entering the mobile number, click on the “Continue” button.

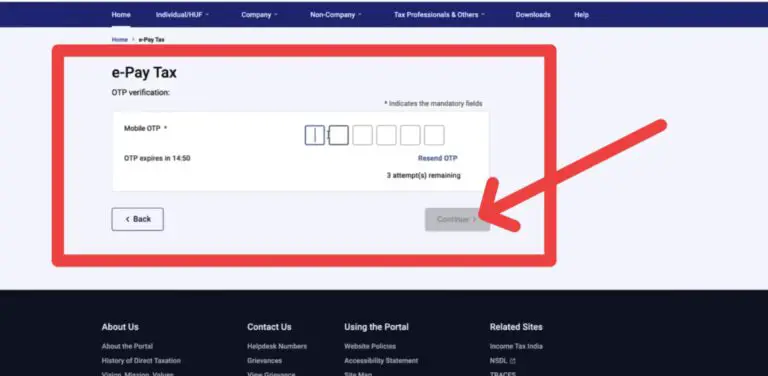

- Then a six digit OTP will come on your given mobile number, enter it and click on “Continue”.

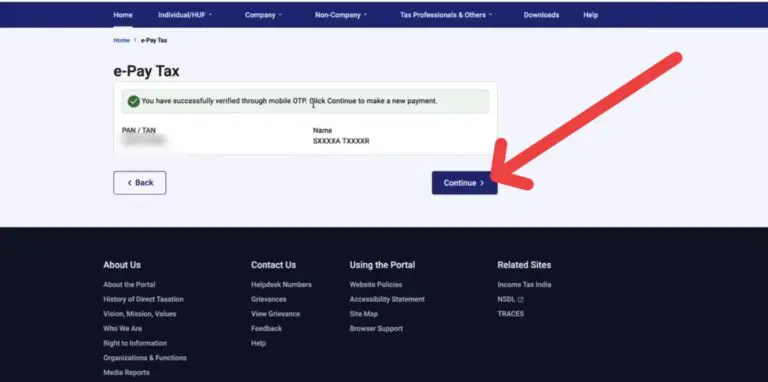

- Then the page related to mobile OTP verification will open in front of you, then click on the “Continue” button below.

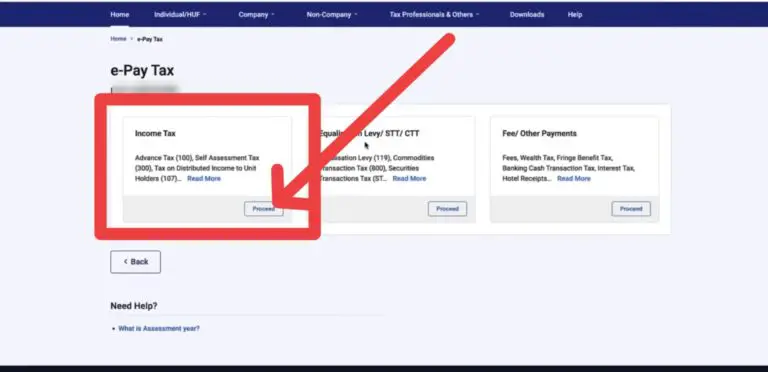

- After that the dashboard will open in front of you, in it you will see three buttons in the form of dialog boxes.

- Out of that, click on the “Proceed” button located in the “Income Tax” mini dialog box.

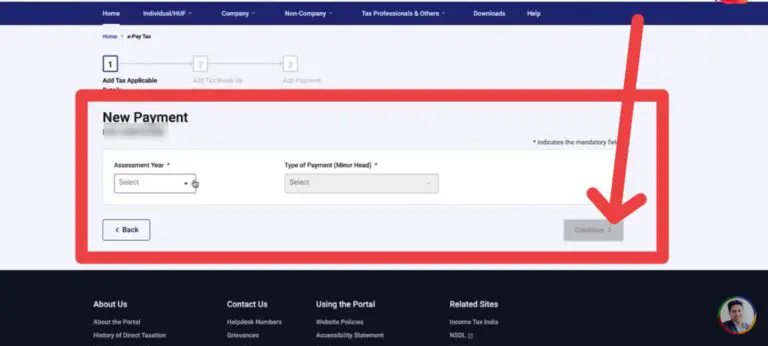

- On clicking, another page will open in front of you, in that you have to select the year as well as the type of payment and click on the “Continue” button.

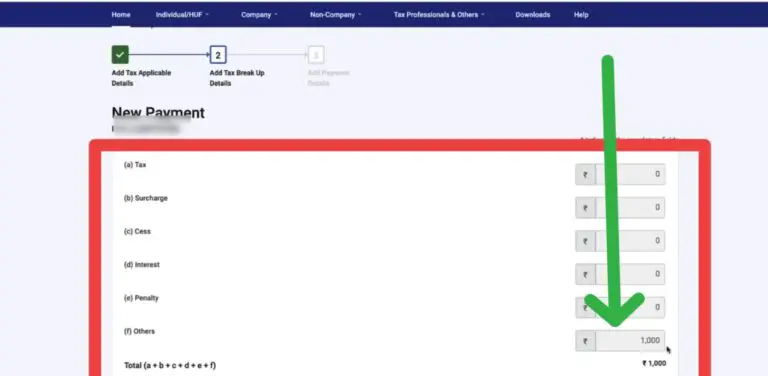

- Then the information related to payment will appear in front of you, in that you choose your fee and click on “Continue”.

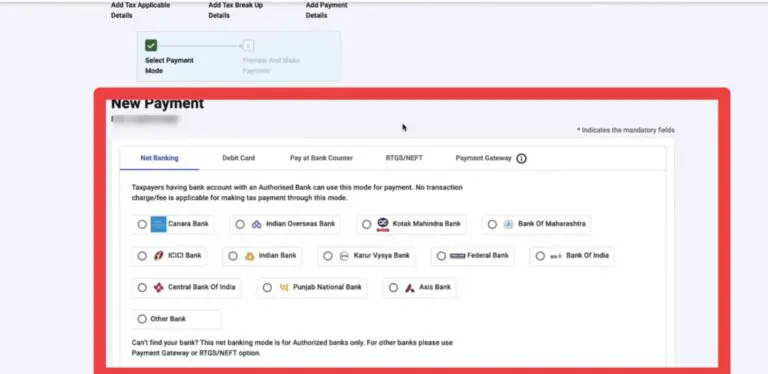

- As soon as you click, the information related to the payment gateway will appear in front of you, then after selecting your bank and choosing your payment mode, you will have to click on “Pay Now”.

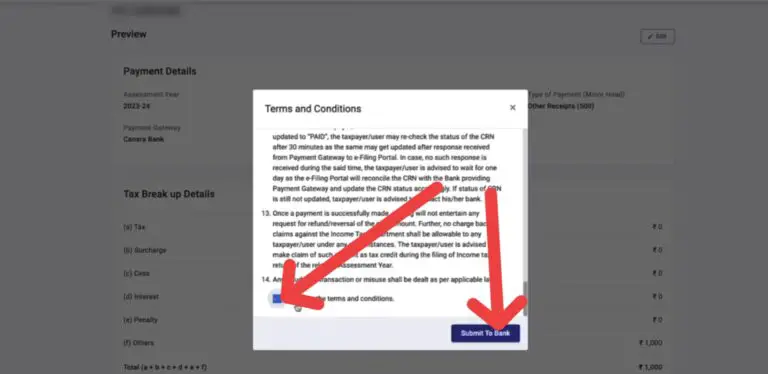

- Then scroll down the page related to “Term of Condition” in front of you and click on the small check box.

- After clicking on the check box, click on the “Submit To Back” button.

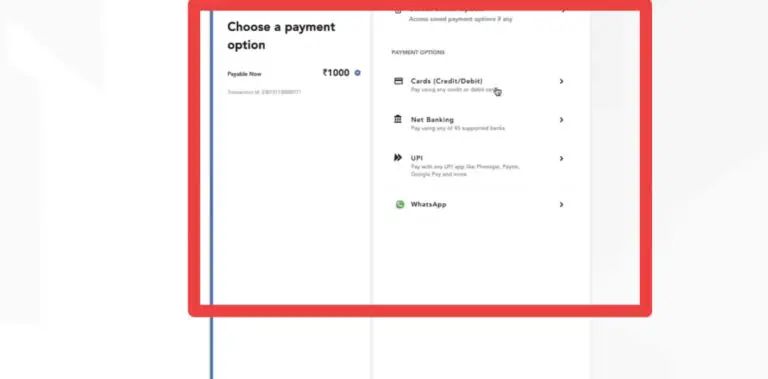

- A page will open in front of you, in which all the options related to your payment will be visible, in that you will have to select any one, then accordingly you will have to make an invoice of one thousand rupees.

- Then another page will open in front of you, in which you can download the receipt by clicking on the receipt button.

- After this your first step will be completed, after that your payment will be approved by Income Tax within seven days.

- Then you have to open the official website of Income Tax, after that go to the section containing Quick Links and click on the button “Link Aadhaar”.

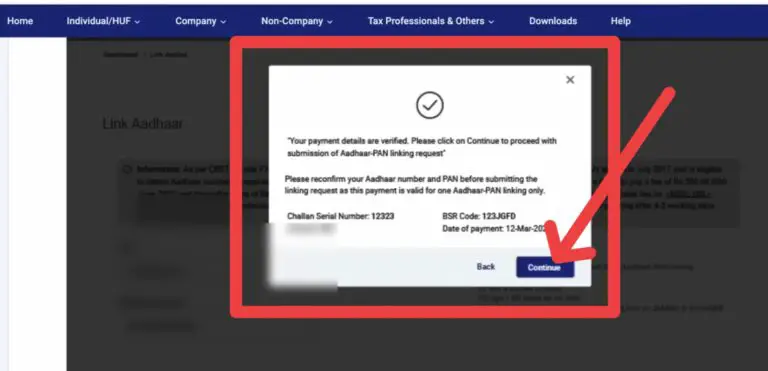

- Then after this you enter the number of PAN card and Aadhaar card then click on “Validate”.

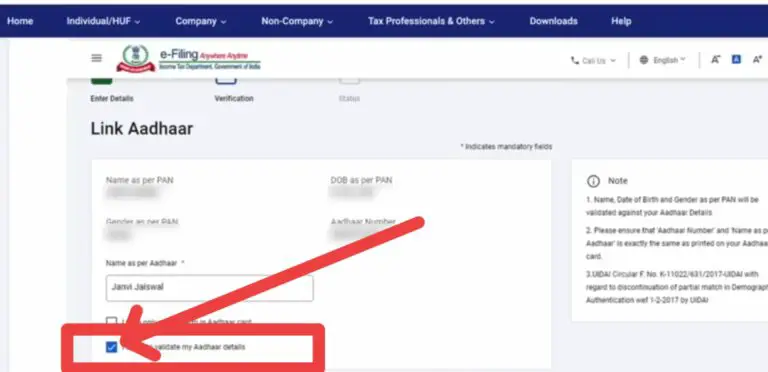

- Then the information related to your Aadhaar card will open in front of you.

- Check it, after that tick the check box below “I have to Validate to My Aadhar Datails” and click on the Link Aadhaar button, your Aadhaar PAN will be linked as soon as you click it.

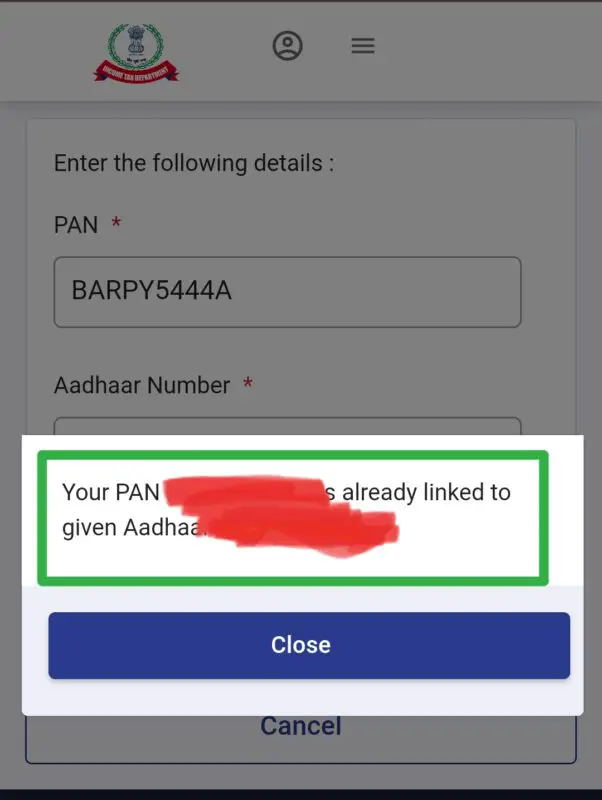

How to know whether PAN card is linked with Aadhaar card or not?

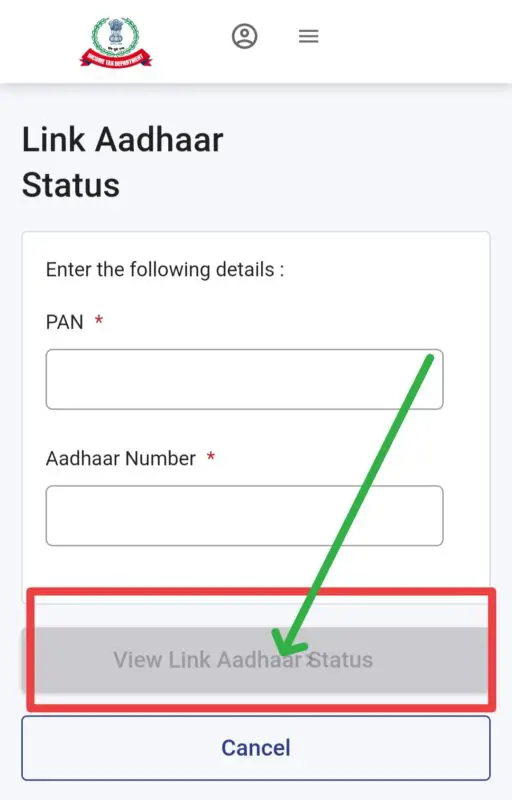

If you need to check Aadhaar-PAN Link Status, you can follow the following steps –

- First of all visit the official website of Income Tax.

- After this you go to the section with “Quick Links”.

- Where you have to click on the button that says “Aadhaar Link Status”.

- On clicking, a page will open in front of you. Where you have to enter PAN number and Aadhaar number and click on “View Link Aadhaar Status”.

- As soon as you click, you will get information related to whether the PAN card is linked to the Aadhaar card or not.

How to do Pan Aadhaar Link through Nsdl SMS Number?

If you also want to link with PAN Aadhaar Link Online SMS Number then you can follow the following steps –

- Taxpayers who want to link Aadhaar number with PAN need to send SMS to 567678 or 56161 from their registered mobile number.

- Its format is UIDPAN<12 digit Aadhaar card><10 digit PAN> then send it to 567678 or 56161.

Pan Card Aadhar Card Link

Check Pan Card Aadhar Card Link Status

FAQ,s Pan Card Aadhar Card Link

Can Aadhaar be linked with the help of PAN mobile number?

Yes, Aadhaar PAN can be linked with the help of SMS with the help of mobile number by following the steps given above.

What is the fee for linking Aadhaar with PAN card online?

The online linking fee for PAN Aadhaar linking is Rs 1000.

What is the helpline number of UIDAI?

Its helpline number is 1800–300–1947.

Why is it necessary to link PAN card with Aadhaar?

You will know that many people in our country do tax evasion, which promotes corruption, and the money does not go where it should go, due to which the country or the state may also have to face losses. Keeping this in mind, it has been made necessary to link PAN card with Aadhaar card.

What is the name of the official website of Aadhaar PAN link?

Its official website name is https://www.incometax.gov.in.

How to know whether PAN card is linked with Aadhaar card or not?

To know whether PAN card is linked with Aadhaar card or not, you can find out through Pan Aadhaar Link Status Nsdl.